Partner with India's most preferred

Mutual Fund Distributor for

UNLIMITED GROWTH

100% Hardwork, 100% commissions

100% support for client acquisition

100% Digital platform

₹0 Registration Fee

Now is the Perfect Time to

Become a MFD

Future of Mutual Fund AUM

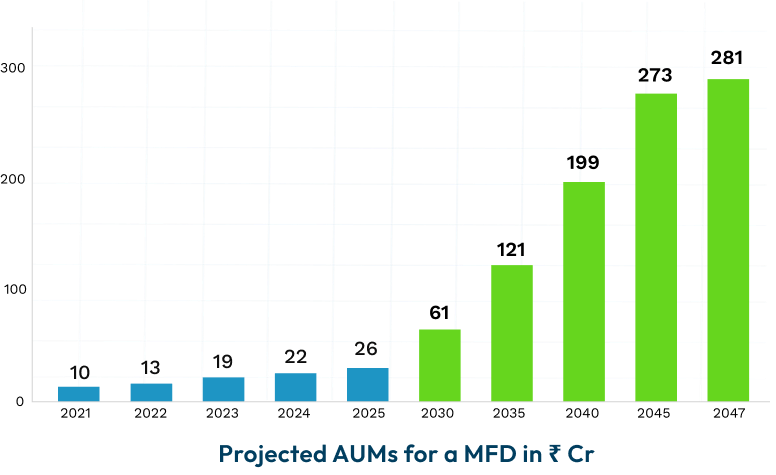

According to AMFI’s vision document commissioned by PwC, MFDs to manage AUM of ₹281 cr per MFD on an average by 2047

Huge Growth Potential

Only 1.5 lakhs MFDs vs 24 lakhs insurance agents

Mutual Fund Penetration Still Low

Only 5%–8% of people invest in India, which is considerably lower compared to other developed nations

WHY 100takka as a partner?

Pure 100% Commission Focus

Industry unmatched commision matching your hardwork.

Fastest Industry Payout

Get your payouts within 3 days of customer's purchase

Grow your business to 5Cr AUM in 3 years

We help you grow your business to 5Cr or 100 SIPs in this period.

All in One Mobile Dashboard

New age digital tool to manage leads, clients, track portfolios and payouts.

Dedicated RM

We are a call away for any help regarding client acquisition, retention, marketing or Operations support

Boost your commission payouts by

Sell more from a wide set of financial products to earn more.

We HELP your Business accelerate by

Identifying and Overcoming Your Key Business Challenges

Crafting a Powerful Marketing Strategy to Maximize Client Reach

Targeted Skill Development Sessions to Boost Client Conversion Rates

Building and Empowering a Dynamic Team under you for Scalable Success

How We Help you Stand & Run your Business

Get started and enrol with 100Takka

Pass the NISM Series V-A certification exam

AMFI Registration and empanelment

Start your journey as a Mutual Fund Distributor

100takka offers a FREE Masterclass, led by experts, to help become a successful MFD.

How Much You Can Earn

The More Clients You Have, The More You Earn !

As your client base grows, so does your earning potential — not just through mutual fund commissions, but also from cross-selling opportunities like Insurance, Bond, NPS and other financial services. With every new client, your income accelerates, helping you build a scalable and rewarding MFD business.

Earnings per month

₹0

Earnings per year

₹0

Potential to Earn More

Give Your Clients One of the Best Investment Apps

Give Your Clients One of the Best Investment Apps

Smart Dashboard

Get a birds eye view of your investments

Wealth Reports

Get a full family view of all your finances

Live SIP

All your current SIPs in one glance

Upcoming Events

Never lose the important events of your finances

Testimonials

Since joining this platform, managing my clients' portfolios has become incredibly efficient. My commission payouts are 100% and I dont have to wait for the month end. These are processed within a week.

FAQs

To sign up for the Mutual Fund Distributor NISM VA exam:

- Create an account on the NISM website by visiting there.

- Fill out the registration form with the appropriate personal and educational information.

- Choose a suitable exam day and location, then pay the exam price online.

There are a few essential procedures in India to become a Mutual Fund Distributor:

1. Pass your NISM exam with Prudent Corporate’s workshops.

2. Get the ARN certification

3. Empanel with Prudent Corporate and start your MFD journey

Absolutely. MFD is a promising career. According to AMFI, as of February 2024, there will only be 1,54,051 mutual fund distributors to service 4,39,08,572 customers.

- Clearing the NISM (National Institute of Securities Markets) exam is a fundamental requirement for becoming a mutual fund distributor in India.

- Obtaining the ARN (AMFI Registration Number) is another basic criterion necessary for distributing mutual funds in India

There is no specified educational requirement according to Association of Mutual Funds of India(AMFI). Anyone interested in finances and having basic knowledge of financial markets can join the Mutual fund industry.

The NISM Series V-A Certification exam is an exam to evaluate a candidate's understanding of mutual funds. The certificate lasts 3 years and requires renewal thereafter.

- Pass your NISM exam with Prudent Corporate’s workshops

- Get the ARN certification

- Empanel with Prudent Corporate and start your MFD journey

There are no particular educational prerequisites for MFDs. Relevant certification such as NISM Series V-A certification and ARN is needed.

Anyone who wants to work as a Mutual Fund Distributor must pass the NISM-Series V-A Mutual Fund Distributor certification exam. NISM Exam link - https://www.nism.ac.in/mutual-fund-distributors/

Normally, applicants have two hours(120 minutes) to complete the Multiple choice based NISM Series V-A Mutual Fund Distributor Exam.

The NISM Series V-A exam evaluates understanding of mutual funds, their composition, and Indian regulations.

To sign up for the Mutual Fund Distributor NISM VA exam:

1. Create an account on the NISM website by visiting there.

2. Fill out the registration form with the appropriate personal and educational information.

3. Choose a suitable exam day and location, then pay the exam price online.